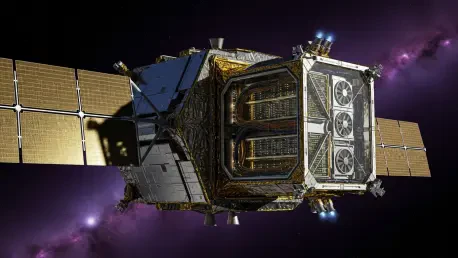

An extensive and detailed analysis of SpaceX’s strategic initiative reveals a potentially revolutionary plan to deploy a constellation of satellites that function as orbiting data centers, a move poised to fundamentally reshape the economics and architecture of the global cloud computing industry. The subject of this analysis is SpaceX’s audacious gambit to transcend its role as a mere telecommunications provider and emerge as a direct, vertically integrated competitor to the established giants of terrestrial cloud infrastructure, namely Amazon Web Services (AWS), Microsoft Azure, and Google Cloud. This initiative signals a paradigm shift from traditional satellite communications—where spacecraft act as simple relays—to a distributed, space-based computing infrastructure that processes data directly in orbit. The overarching trend identified is the convergence of connectivity and computation in low Earth orbit (LEO), creating a new frontier known as the “orbital cloud” and extending the concept of edge computing to the vacuum of space.

The New Frontier: Blurring the Lines Between Space and Cloud

For years, the industries of low Earth orbit satellite communications and terrestrial cloud computing have operated in largely separate spheres, each dominated by its own set of titans. In space, players like SpaceX’s Starlink, Amazon’s Project Kuiper, and OneWeb have focused on blanketing the globe with internet connectivity. On the ground, AWS, Microsoft Azure, and Google Cloud have built a multi-trillion-dollar industry by centralizing data processing and storage in massive, land-based data centers. These two worlds, one focused on data transit and the other on data processing, have historically complemented each other without significant overlap in core infrastructure.

SpaceX’s initiative to build an orbital cloud network represents a radical convergence of these two domains. By proposing to embed data center capabilities directly into its Starlink satellites, the company is not merely enhancing its communication network; it is challenging the fundamental architecture of the cloud itself. This move blurs the previously distinct lines between connectivity provider and computation provider, creating a new, hybrid market segment. The implications are profound, setting the stage for a new competitive paradigm where the strategic high ground may no longer be on Earth, but hundreds of miles above it.

The Orbital Edge: Trends and Projections for Computing in Space

Redefining the Satellite: From Simple Relay to Orbiting Data Center

The core technological trend fueling this strategic pivot is the evolution of the satellite from a simple “bent-pipe” relay into an active, intelligent computing node. The traditional model involves beaming data from a user to a satellite, which then reflects that signal back down to a terrestrial ground station connected to the internet and cloud infrastructure. SpaceX’s vision transforms this architecture into a distributed, space-based mesh network where satellites can process, store, and route data between one another, creating a computing fabric in orbit. This effectively moves the data center closer to the data source for a significant portion of global users.

This architectural shift promises several transformative benefits for enterprise customers. The most significant is a drastic reduction in latency, as data no longer needs to make the long round trip to a distant ground station and back. For applications in autonomous shipping, remote industrial monitoring, or in-flight connectivity, processing data in orbit could enable real-time decision-making that is currently impossible. Furthermore, this vertical integration offers a single-vendor solution for both connectivity and computation, simplifying procurement and enhancing security. By extending the principles of edge computing to the final frontier, SpaceX is proposing a model where the network itself is the computer.

Sizing the Celestial Market: Growth Forecasts and Economic Impact

The financial potential of an orbital cloud network is immense, representing a direct challenge to the lucrative terrestrial cloud market. Current market analysis projects the specialized sector of edge computing in space to expand significantly, with forecasts suggesting a market size of $2.8 billion by 2030, growing at a compound annual rate of 24.3%. While this is a fraction of the overall cloud market, it represents a high-growth entry point that SpaceX is uniquely positioned to capture, potentially leveraging it to peel off specific enterprise workloads from incumbent providers.

The economic incentives are particularly compelling for industries operating in remote or mobile environments. Sectors like aviation, maritime logistics, agriculture, and energy exploration stand to gain enormous efficiencies from a unified platform that delivers both high-speed connectivity and localized data processing. For a shipping company managing a global fleet, the ability to process telemetry and navigational data directly on the network without relying on intermittent connections to shore-based data centers is a game-changer. This creates a powerful value proposition, where the combination of connectivity and computation from a single provider becomes not just a convenience, but a critical competitive advantage.

Engineering Against the Void: The Technical Challenges of an Orbital Cloud

Despite the promise, operating a data center in the harsh environment of space presents a host of formidable engineering obstacles. The most critical is thermal management. On Earth, data centers rely on air and liquid to cool power-hungry processors, but in the vacuum of space, these methods are useless. Engineers must design sophisticated passive and active radiation systems to dissipate heat into the void, a challenge that grows exponentially with the computational density of the hardware. Any failure in this system could lead to catastrophic overheating and permanent damage to the satellite’s core function.

Furthermore, the hardware itself must be resilient to the unique hazards of orbit. Satellites are constantly bombarded with cosmic rays and high-energy particles that can cause “bit flips”—random errors in data—or even physical damage to sensitive semiconductor components. This necessitates the use of expensive, radiation-hardened electronics, which adds significant cost and complexity to the design and manufacturing process. Power generation is another persistent challenge. The satellites require large, efficient solar arrays and robust battery systems to ensure uninterrupted operation as they pass through Earth’s shadow. While SpaceX’s expertise in mass manufacturing and launch gives it an advantage, overcoming these fundamental physics problems at scale will be a monumental undertaking.

Celestial Traffic Control: Navigating the Regulatory Minefield

Beyond the immense technical hurdles, SpaceX must navigate a complex and increasingly crowded regulatory landscape to make its orbital cloud a reality. The lifeblood of any satellite network is radio frequency spectrum, a finite global resource for which competition is ferocious. To support its vision, SpaceX requires licenses for multiple frequency bands: one for user uplinks, another for downlinks, and a third for the crucial laser-based inter-satellite links that will form the backbone of the orbital mesh network. Securing these allocations from bodies like the Federal Communications Commission (FCC) in the United States and the International Telecommunication Union (ITU) globally is a contentious process.

Rivals, including both established operators and emerging competitors like Amazon’s Project Kuiper, have raised significant concerns about potential signal interference from SpaceX’s densely packed mega-constellation. They argue that the sheer number of Starlink satellites, combined with their proposed new functions, could disrupt existing and future services, creating a chaotic environment in orbit. This has prompted regulators to reconsider the existing rules, which were designed for a much smaller number of satellites. The outcome of these deliberations will have profound implications, not only for SpaceX but for the entire space industry, setting precedents that will govern the development of orbital infrastructure for decades to come.

A Disruption from Above: The Future of the Cloud Competitive Landscape

Should SpaceX succeed, its venture is poised to cause a significant disruption in the established cloud computing market, which generated approximately $270 billion in revenue in the past year. Capturing even a small percentage of this market would create a massive new revenue stream for SpaceX, further diversifying its business beyond launch services and consumer broadband. This move forces the incumbent cloud giants into a difficult strategic position, forcing them to look skyward to defend their market share.

Amazon faces a particularly interesting challenge, as it operates both the world’s leading cloud platform in AWS and a direct Starlink competitor in Project Kuiper. SpaceX’s integration of computing and connectivity could compel Amazon to accelerate its own plans for a space-based cloud extension to avoid ceding a critical first-mover advantage. Meanwhile, Microsoft and Google, which lack in-house launch capabilities, may be forced to forge strategic alliances with other aerospace companies or even become customers of their new competitor to offer similar orbital services. The defense and intelligence sectors also represent a key battleground, where the demand for secure, resilient, and tactical edge computing is rapidly growing. SpaceX’s existing relationships with the U.S. government through its Starshield program could provide a significant advantage in capturing this high-value market.

A Paradigm Shift in Orbit: Final Analysis and Future Prospects

SpaceX’s plan to create an orbital data network represents more than an incremental improvement in satellite technology; it signals a fundamental transformation in how global data infrastructure is conceived and deployed. The evolution of satellites from passive relays to active computing nodes marks a paradigm shift with the potential to be as impactful as the historic transition from centralized mainframes to distributed cloud computing. This initiative is not merely about providing faster internet to remote locations but about creating an entirely new platform for global computation.

The success of this ambitious venture is by no means guaranteed. It hinges on the company’s ability to overcome immense technical, regulatory, and financial hurdles in parallel. The engineering required to operate data centers in the void is unprecedented, the battle for spectrum is fraught with political and competitive challenges, and the capital investment required is astronomical. However, the convergence of orbital and terrestrial computing resources now appears to be an inevitable step in the evolution of information technology. Whether SpaceX ultimately dominates this new frontier or simply acts as the catalyst for a broader industry-wide race to space, its ambition is already redefining the boundaries of the cloud and charting a course for the next generation of global data infrastructure.