Why uptime hides systemic market risk

When a handful of cloud and network platforms hiccup, airlines strand travelers, payments stall, and connected devices freeze while status pages still glow reassuring green because the metric called “uptime” rarely aligns with real service continuity across complex, vendor-layered systems. That gap is a market flaw, not a rounding error. Buyers have treated provider availability as a proxy for resilience, but recent incidents showed how inefficiencies surface when dependencies stack and propagate. The purpose here is to recast resilience as a market variable—priced, benchmarked, and designed—rather than a promise rented from a single platform.

The analysis matters because concentration has outpaced transparency. A small group of hyperscalers, identity platforms, CDNs, DNS operators, and payment rails now anchor digital operations for most sectors. As vendors standardize on the same building blocks, cost curves improve while fragility grows. The goal is to translate that technical reality into market guidance: where risk accumulates, how to discount vendor claims, and which investments shift performance from brittle excellence to durable reliability.

Expect a reframing of benchmarks. Instead of treating five nines as the finish line, leading buyers are purchasing graceful degradation, diversified control planes, and tested failover. That shift favors providers who disclose upstream dependencies, publish recovery evidence, and treat chaos testing as a product signal, not a stunt.

Market structure and demand signals behind concentration

Cloud economics rewarded scale. Hyperscalers lowered barriers to compute, storage, data, and identity, which turbocharged software delivery and tilted procurement toward standard stacks. Adjacent markets—observability, CI/CD, data pipelines, and edge networks—consolidated along those gravity wells. The result is a tight core plus a crowded periphery that shares the same backbone, often invisibly, through two or three vendor tiers.

This structure changed buyer behavior. Enterprises outsourced not only infrastructure, but also control planes: DNS, identity, traffic management, and secrets. Software firms did the same, embedding managed services into their products. Even firms resistant to cloud adoption became indirect consumers through upstream vendors. This is a supply chain by another name—multi-tiered, global, and opaque. In procurement terms, risk exposure expanded while visibility receded, a classic adverse selection problem during incidents.

The implications are clear in incident data. Outages at large providers have produced broad, cross-industry side effects: ground stops at airlines, stalled checkout flows, broken logins, and silent degradations in IoT. The economic signal is larger than SLA penalties; it includes churn, higher support costs, desynchronized data, and refactoring expenses. Markets are beginning to price these dynamics as a resilience premium, favoring vendors who can prove isolation, recovery speed, and fallbacks that work under load.

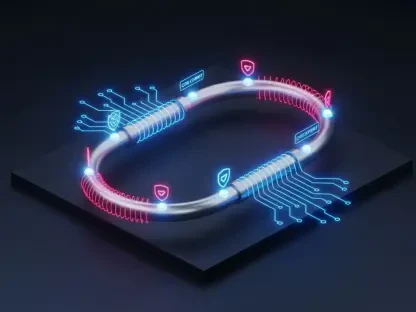

The hidden supply chain of cloud-era vendors

The myth that “not using a given hyperscaler” confers insulation dissolves under scrutiny. Most enterprise stacks consume those platforms indirectly via SaaS, APIs, analytics pipelines, auth layers, or the CI/CD systems that ship code. These links sit beyond the first contractual hop, so they remain invisible until they fail. Postmortems repeatedly expose centralized DNS, single-tenant identity, or shared managed databases underpinning multiple products in the same company.

The benefit of recognizing this supply chain is sharper risk allocation. Once dependencies are mapped, buyers can tier vendors by business criticality, stress test realistic failures, and decide where diversity pays for itself. The trade-off is cost and complexity: segmentation means duplicative contracts, additional runbooks, and more operational skill. Yet the market momentum favors teams that turn opacity into an investment thesis—buy clarity, not just capacity.

Cascades that inflate real costs

Cascades transform single events into sector-wide disruptions. When identity or networking falters upstream, downstream services fail in non-obvious ways: retries saturate queues, circuit breakers misfire, and sidecars exhaust resources. In late 2025, incidents across major clouds and a leading network edge provider produced visible outages in airlines, gaming, streaming, and household devices, while less-visible impacts multiplied in logistics and finance back offices.

These costs exceed downtime tallies. Legal exposure rises when transactions hang mid-flight; customer support surges as status remains ambiguous; and engineering debt accumulates when emergency patches outrun architectural intent. For public services, the externalities are social: interruptions in clinics, utilities, and emergency communications compound harm. Investors and boards now ask for recovery evidence in addition to availability claims, shifting diligence from uptime to end-to-end continuity.

Policy pressure and SLA optics

Regulators have intensified scrutiny of hyperscalers and critical intermediaries, adding transparency mandates and stress-test expectations in sectors like finance and healthcare. These moves raise the floor, but they do not end the most common failure modes: routine changes, subtle misconfigurations, and imperfect rollbacks. SLAs track provider-side uptime; they do not guarantee a customer’s composite service, nor do they cover multi-vendor compounds.

The market read is pragmatic. Compliance reduces some systemic risk, but it cannot substitute for architectural independence. Misconceptions linger—that multi-region equals multi-cloud, that backups equal restorability, that a documented disaster plan equals readiness. Buyers now favor vendors who demonstrate isolation across identity, DNS, and CI/CD, and who publish failover drills with measurable recovery times and recovery points.

Forward view: shifts redefining the resilience premium

Three forces are reshaping the curve. Economically, consolidation around a handful of core platforms continues while specialized AI, edge, and data services deepen cross-dependencies. Technologically, teams adopt more managed components—vector search, serverless dataflows, managed identities—which accelerates delivery and intensifies coupling. Operationally, AI-led automation speeds change velocity, amplifying both improvements and errors.

Pricing power is following proof, not promises. Vendors who can show active-active designs, cross-provider identity, and segmented control planes are winning strategic deals despite higher sticker prices. Buyers are inserting resilience SLAs that measure business outcomes—graceful read-only modes, bounded queue growth, and time-to-recovery—rather than just infrastructure availability. The expected result is a bifurcation: commodity providers competing on cost, and resilience-forward providers commanding premiums in regulated and high-stakes segments.

On the regulatory horizon, transparency rules and sector stress tests expand. These measures encourage standardized dependency disclosures and incident reporting that improves market signals. However, they still leave human error and complex failure modes intact, reinforcing the need for buyer-led architecture and operational drills. The trajectory suggests a durable market segment for resilience tooling—chaos platforms, multi-cloud orchestration, and vendor dependency intelligence.

Strategic playbook for buyers and operators

Winning strategies start with a map. Catalog first-, second-, and third-tier dependencies across DNS, identity, networks, CI/CD, observability, data stores, and payment processors. Tie that map to incident runbooks so responders know which systems to throttle, which to shift, and which to pause. Treat the inventory as a living artifact updated with each vendor change and each significant release.

Next, align design with business reality. Rank functions by criticality; define recovery time and recovery point objectives that reflect actual tolerance for loss and delay; and architect for those targets rather than wishful service levels. For truly critical flows, consider cross-cloud or cross-identity patterns; for everything else, engineer graceful degradation—feature flags, backpressure, idempotent writes, and read-only fallbacks that preserve core value under stress.

Finally, replace static assurance with practice. Conduct game days that cross teams and vendors; rehearse manual failovers; measure time to detection, decision, and recovery; and convert findings into code, contracts, and coordination changes. In procurement, demand upstream dependency disclosures, evidence of failover drills, and audit trails of incident learnings. Resilience becomes a buying criterion and a marketing advantage when it is observable.

What the market already priced in—and what to do next

This analysis concluded that the digital economy’s efficiency came with concentration risk that blurred behind glossy uptime metrics. Indirect reliance on a narrow core of platforms magnified blast radii, raised hidden costs, and eroded trust when incidents spread through layered stacks. Policy shifts and SLA language improved transparency but did not neutralize routine error, leaving architecture and practice as the decisive levers.

The market implication had been straightforward: resilience earned a premium where failure carried systemic impact. Teams that mapped dependencies, prioritized critical paths, diversified control planes, and drilled failovers reduced losses and negotiated better terms. Providers that disclosed upstream ties and published recovery evidence gained advantage in complex deals. The next steps hinged on execution—treating resilience as a measurable product attribute, not a promise—and on aligning investment with the business moments that must never fail.