The financial technology sector has experienced remarkable evolution due to the rapidly changing landscape of regulations, technological breakthroughs, and user expectations. Fintech firms face mounting pressure to continuously innovate and adapt to remain competitive in this fast-paced domain. New regulatory requirements, coupled with user demands for intuitive experiences, further complicate this endeavor. Successful companies must seamlessly merge user experience with compliance, a task that often necessitates collaboration with adept software development teams. These partnerships ensure not just flawless code but also strategic insights enabling platforms to thrive amidst the ever-shifting terrain.

Continuous Innovation in Fintech

Adapting to Regulatory Changes

Navigating the evolving regulatory landscape remains a formidable challenge for fintech firms seeking sustained growth. Regulatory bodies frequently introduce new standards and requirements, compelling companies to be agile in adapting their services to remain compliant. Beyond mere compliance, firms must ensure their apps maintain ease of use while adhering to these standards. This intricate balance often makes strategic partnerships with experienced software developers indispensable. These collaborations provide fintech companies with the technical prowess and regulatory insights necessary to innovate responsibly. This blend of skill and knowledge offers a robust solution to compliance, enabling firms to deliver user-friendly and compliant applications.

Successfully navigating regulatory changes also requires ongoing education and awareness of emerging legislative trends. The proactive approach to staying informed helps fintech firms anticipate and respond to modifications before they are mandated. This foresight prevents costly overhauls and enables smoother integration of regulatory demands into existing systems. Moreover, partnerships with developers versed in fintech regulations can offer a more profound understanding, allowing firms to craft solutions that preemptively align with upcoming rules. This holistic strategy supports continuous service evolution while ensuring user experiences remain seamless, thereby securing customer trust and improving market position amid regulatory changes.

Responding to User Demands

In today’s competitive fintech environment, user expectations are continuously rising, pushing companies to provide standout experiences that anticipate and meet needs with precision. Users expect applications to offer intuitive interfaces simulating human-like interactions, which requires going beyond basic functionality. Companies must ensure their apps exude simplicity while providing depth, allowing users to feel understood and supported in their financial endeavors. This demands a clear understanding of user metrics and behavior to identify and address pain points effectively. By focusing on enhancing user satisfaction, fintech firms can cultivate heightened engagement and loyalty.

Delivering on user demands goes beyond adapting current technologies; it involves predicting future needs and preparing to address them proactively. Fintech applications must evolve and innovate continually, staying ahead of user demands to offer groundbreaking features that captivate audiences. Insights from data analytics become instrumental in this endeavor, offering a wealth of information to finetune user interactions. These insights allow applications to tailor experiences dynamically, resulting in more personalized and rewarding user journeys. As fintech continues its meteoric rise, companies that successfully integrate analytics and user foresight into design and development are positioned to dominate the user satisfaction market.

Integrating Smart Technologies

Smart Beyond Code

In the era of artificial intelligence, fintech applications must go beyond mere coding efficiency to offer truly intelligent and user-centric solutions. While AI garners much attention, applications must focus on delivering intuitive responses rather than inundating users with complex data reports. For example, in the domain of fraud detection, machine learning tools play a pivotal role by recognizing patterns unnoticed by human analysts. However, it is crucial that these sophisticated systems work invisibly in the background, ensuring that users encounter empathetic and coherent interaction during critical moments. This prevents confusion and enhances trust in the technology deployed.

Creating applications that exemplify intelligence involves a nuanced approach where advanced technologies subtly enhance user interaction. This demands a shift from highlighting technical sophistication toward achieving a fluid user experience. Applying AI to tasks like fraud detection must seamlessly fit into operations, ensuring clarity and empathy. Such efforts help users navigate complex fintech processes effortlessly while preserving intuitive engagement. The goal is to integrate technical innovation with simplicity, offering users an effortlessly intelligent interface that requires no additional learning curve, thus guaranteeing a satisfying and frictionless experience in every interaction.

Embedded Finance Trends

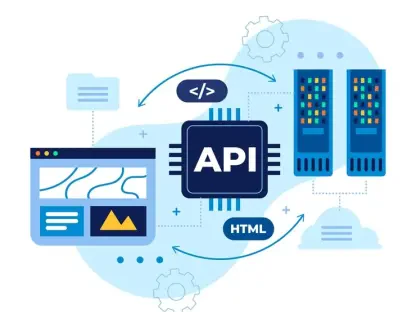

Embedded finance emerges as a transformative trend, reshaping the financial services landscape by incorporating them into non-traditional platforms. This integration extends across diverse environments like e-commerce, ride-sharing, and retail applications, allowing financial services to reach users in daily contexts. For fintech developers, adapting to this trend requires focused efforts on creating efficient APIs and robust integrations that guarantee seamless operation across disparate systems. These developers must manage and streamline multiple complex processes to achieve cohesive, compliant user experiences that align with embedded finance’s advancing role.

Incorporating financial services into unconventional platforms presents opportunities but also challenges, necessitating meticulous coordination among stakeholders to ensure consistent delivery of financial solutions. As businesses increasingly embed financial functions into broader digital ecosystems, developers must prioritize flexibility in system design and architecture. By optimizing API interactions and pursuing collaborative synergies with partners, developers can expand the reach of financial services while navigating potential technological and regulatory obstacles. Successful embedded finance deployments hinge on crafting solutions that overcome these intricacies and resonate positively with users, cementing their indispensability within everyday digital interactions.

Personalization and User Loyalty

Genuine Personalization

The pursuit of personalization has become integral, with fintech applications expected to adjust to users’ unique lives and changing circumstances. Merely offering superficial insights no longer suffices; users tend to find such attempts more insidious than helpful. Meaningful personalization goes beyond user information to deliver context-aware and adaptive support. Fintech companies aim to create experiences reflecting genuine understanding, adapting seamlessly to users’ evolving needs. This empathy-driven approach not only meets user expectations but also fosters stronger loyalty. Personalized experiences have shown significant improvement in user retention and attraction, proving instrumental in maintaining a competitive edge.

Incorporating advanced personalization techniques into fintech applications requires an acute understanding of user circumstances and priorities. By deploying algorithms to capture and process real-time data, applications can dynamically adjust to meet individual needs and preferences. This approach refines every facet of user interaction, allowing companies to craft experiences that evolve concurrently with users. The resulting personalized experiences transform fintech applications from mere tools into comprehensive financial ecosystems, ready to support users during every financial transition. In an overcrowded market, meaningful personalization emerges as the key differentiator, offering companies a definitive path to sustainable growth and user loyalty.

The Role of Data

While data remains the cornerstone of personalization strategies, effective use depends considerably on insightful application rather than mere collection. Acquiring vast datasets without context-aware interpretation risks reducing user experience quality. Instead, building personalization capabilities demands calibration, analyzing collected data to reveal relevant insights into user behavior and preferences. Applications then leverage this understanding to make substantial user experience improvements, supporting decisions that resonate with individualized conditions and real-time needs. Engaging users with perpetually adaptive environments increases satisfaction while yielding benefits such as enhanced loyalty and reduced churn rates.

The effectiveness of data-driven personalization enriches the user journey, transforming fintech interactions into deeply rewarding endeavors. By emphasizing quality over quantity and prioritizing context-aware adaptation, fintech applications can forge meaningful connections with users, customizing experiences to suit individual lifestyles. Achieving this holistic understanding requires advanced analytics and machine learning tools that shift focus from data collection to refined, nuanced interpretation. Successful personalization strategies acknowledge this evolution, addressing consistent demands for adaptability and relevance, fortifying the role of fintech applications as personalized companions in users’ financial lives.

Security in Fintech

Behavior-Based Security

In the realm of modern fintech, security continues to evolve from traditional protective techniques toward incorporating behavior-based approaches. This innovative method analyzes how users interact with their devices, examining details such as typing dynamics or login patterns to detect anomalies and potential threats. By leveraging these insights, fintech applications can craft defenses against more complex security threats with unparalleled precision. Human intervention remains critical to address exceptional circumstances, ensuring flexibility in tailoring security systems to individual user patterns. Harnessing behavior-based insights strengthens the security ecosystem, providing enhanced safeguarding mechanisms in line with user requirements.

Understanding and deploying behavior-based security techniques require an iterative learning process, adapting systems dynamically to identify both potential threats and anomalies. Incorporating machine learning and artificial intelligence, this approach efficiently addresses broader security challenges, ensuring as-needed adjustments for evolving environments. An emphasis on behavior analytics allows for precise threat detection, improving response strategies significantly and adapting alongside user behavior changes. As fintech applications continue expanding, behavior-based security offers a vital safeguard, delivering enriched protection adapted to the contemporary needs of increasingly complex and user-centric financial ecosystems.

Maintaining Infrastructure Stability

The financial technology sector has undergone significant transformation, driven by rapidly evolving regulations, technological advances, and shifting user expectations. Fintech companies face growing pressure to innovate continuously and adapt, maintaining competitiveness in this swiftly changing arena. The challenges are compounded by new regulatory standards and heightened user demands for seamless and intuitive experiences. Firms that succeed are those that effectively integrate user experience with regulatory compliance. This often requires collaboration with skilled software development teams, who play a crucial role in crafting not only impeccable code but also providing strategic insights. These partnerships are essential for creating platforms that can flourish amid the constantly changing conditions. To navigate these complexities successfully, fintech companies need to stay at the forefront of technological advancements and regulatory shifts while keeping user experience at the core of their offerings.